New York’s economy is in dire straits

Albany. A preliminary economic impact assessment forecasts pre-COVID-19 economic recovery by first quarter of 2023.

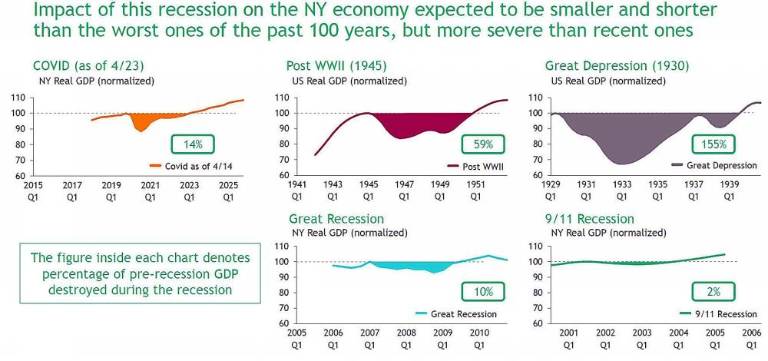

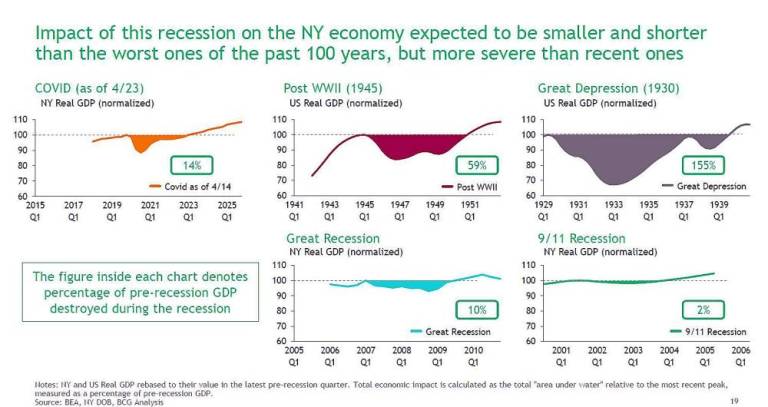

A preliminary economic impact assessment compiled by Boston Consulting Group at the request of New York State suggests the total impact on New York's economy will be $243 billion over the course of the full recovery relative to pre-COVID-19 economic levels, which is equivalent to approximately 14 percent of New York's 2019 gross domestic product (GDP), or the value of economic activity.

Additionally, there is a $202 billion loss relative to pre-COVID-19 GDP growth trends, bringing the total loss to $445 billion.

This impact is greater than the Sept. 11 terrorist attacks or the 2008 Great Recession which caused an economic impact equivalent to -2 percent and -10 percent of real GDP respectively, according to the report.

Based on this analysis, the economy would recover to the “pre-COVID-19” level in first quarter of 2023, the report said. Its analysis already accounts for the positive economic effects of new federal aid for unemployment insurance and economic impact payments, suggesting significant funding gaps are likely to remain despite CARES Act.

Both the degree of impact and recovery paths vary by industry. However, the report said, the impact is widespread, affecting most industries and all New York regions.

The report stressed the analysis is based on several key assumptions. The actual impact could be even more severe, including:

• Short-term impacts. The economy has been deteriorating rapidly, and the pace of deterioration could continue to exceed expectations

• Timing of restart. Analysis assumes restart at the beginning of Q3 2020, which depends on continued success fighting the epidemic and putting in place the conditions which would allow a safe restart minimizing the risk of resurgence

• Pace of restart. Significant uncertainty remains about how quickly certain industries, geographies and population segments will return to normal activity

• Additional epidemic waves. Additional waves (or resurgence due to premature restart) could require re-introduction of health measures interrupting recovery

• Tax structure. Analysis assumes no change to current taxes. However, tax policy decisions could delay the pace and extend the duration of the recovery

Additionally, according to the report, New York’s revenues are projected to decline by $13.3 billion from the Division of the Budget's February forecast. Year-over-year “All Funds” tax receipts declined by 8.9 percent or $7.4 billion.

As part of this, the report noted:

• To date, New York has not received any funding to offset the revenue shortfall. In the absence of additional revenue, significant reductions in spending will be needed (e.g., 84 percent of “All Funds” taxes - excludes miscellaneous receipts, gaming, and federal funds - is from sales and personal income taxes, which face steep declines)

• New York will need financial support from the federal government above and beyond the funding allocated to date. Funding made available, so far, helps mitigate certain impacts, but leaves significant gaps.

• Where possible, analysis already accounts for the positive economic effects of some federal funding (unemployment insurance, economic impact payments).

• Most funding is aimed at avoiding damage vs. recovering from damage to date.

• In some cases, federal funding being allocated is based on existing formulas and not distributed based on COVID-19 impact/economic need.

The report said the health of the New York economy is tied to the health of the entire country and has been hit harder by COVD-19 than any other state, with 31 percent of all nationwide cases in New York, and 37 percent of deaths nationwide.

While nationwide social distancing policies have begun to reduce the rate of infections, hospitalizations, and deaths, the report noted there’s been “significant economic harm.”

To estimate the total harm to New York's economy, the report analyzed the impact to date on New York industries, and potential rates of recovery. It included the impact based on sources including unemployment claims and credit card sales, with additional analysis performed for key New York industries.

As examples:

• New York unemployment has risen by 2,104 percent and credit card sales have gone down by 20 percent

• Forecasts say tax revenue could decline by $13.3 billion in SFY 2021 compared to the Division of the Budget's February forecast, and $61 billion for SFY's 2021-2024

For modeling purposes, the report said the "restart date" for the New York economy is currently assumed to be in early Q3 2020 – consistent with latest modeling assumptions – although for specific industries, the start date could be sooner or later as public health data permits.

The report looked at the shape of recovery for the accommodation and food, finance and insurance, construction, health care and social assistance and transportation industries, informed by performance in past recessions and estimated total reduction in New York GDP, analyzing interaction effects between industries and regions.